China's New Energy Vehicles: From New Car Launch Wave to Sales Realization (Past 3 Years)

Executive Summary

Based on market data analysis from 2023 to 2025, China's new energy vehicle (NEV) market exhibits characteristics of "high launch enthusiasm" coexisting with "sales differentiation":

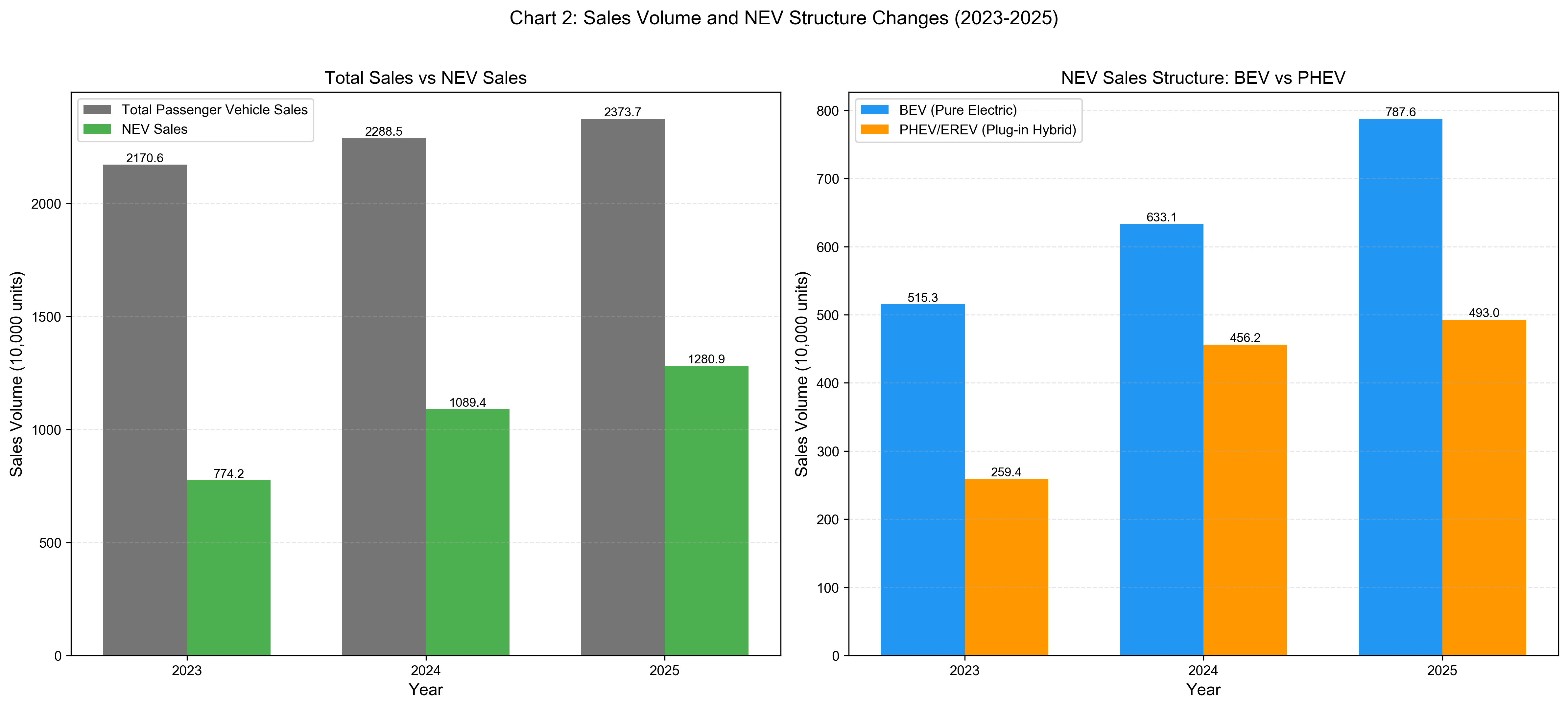

- Total Volume Realized but Growth Slowing:NEV annual sales grew from 7.742 million units in 2023 to 12.809 million units in 2025. The intensive launch of new vehicles indeed drove overall market expansion, but year-over-year growth has declined from 40.7% in 2024 to 17.6% in 2025.

- Structural Mismatch Highlighted:The increase in new car launches has not uniformly translated into sales. Plug-in hybrid (PHEV/EREV) models have become the core driver of sales growth, while pure electric (BEV) models have encountered growth bottlenecks. Some BEV owners even show willingness to "reverse flow" back to gasoline vehicles.

- Innovation Drives Better Than Price Wars:Data shows that pure price competition has extremely limited net stimulation effect on sales (only 3.6%), while technological innovation (such as advanced autonomous driving and ultra-fast charging) has a more significant pull on consumer decisions (10.8%).

- Head Effect Intensifies:Although approximately 20 new brands entered the market in the past 3 years, consumers' "initial brand consideration set" remains highly concentrated (only 2-3 brands). Sales are highly concentrated in BYD, Tesla, and a few leading new force brands, with many newly launched models facing the risk of "silence upon launch".

1. Data Sources and Methodology

This report is based on the following data sources:

- New Car Launch Data: Covers the new car launch list for China's passenger vehicle market from January 2020 to January 2026, with a focus on model launch records from 2023-2025.

- Sales Data: Based on annual total sales, NEV segment sales, and brand/model sales rankings for China's passenger vehicles from 2020-2025 provided by Yiche.

- Consumer Insights: References McKinsey's 2023-2025 China automotive consumer research reports, covering approximately 2,500 consumers' car purchase decisions, brand awareness, and technology preferences.

This report defines "the past 3 years" as 2023, 2024, and 2025, where data is most complete. The analysis focuses on revealing structural characteristics of market conversion by comparing new car launch rhythm (supply side) with actual registration sales and consumer feedback (demand side).

2. New Car Launch Trends

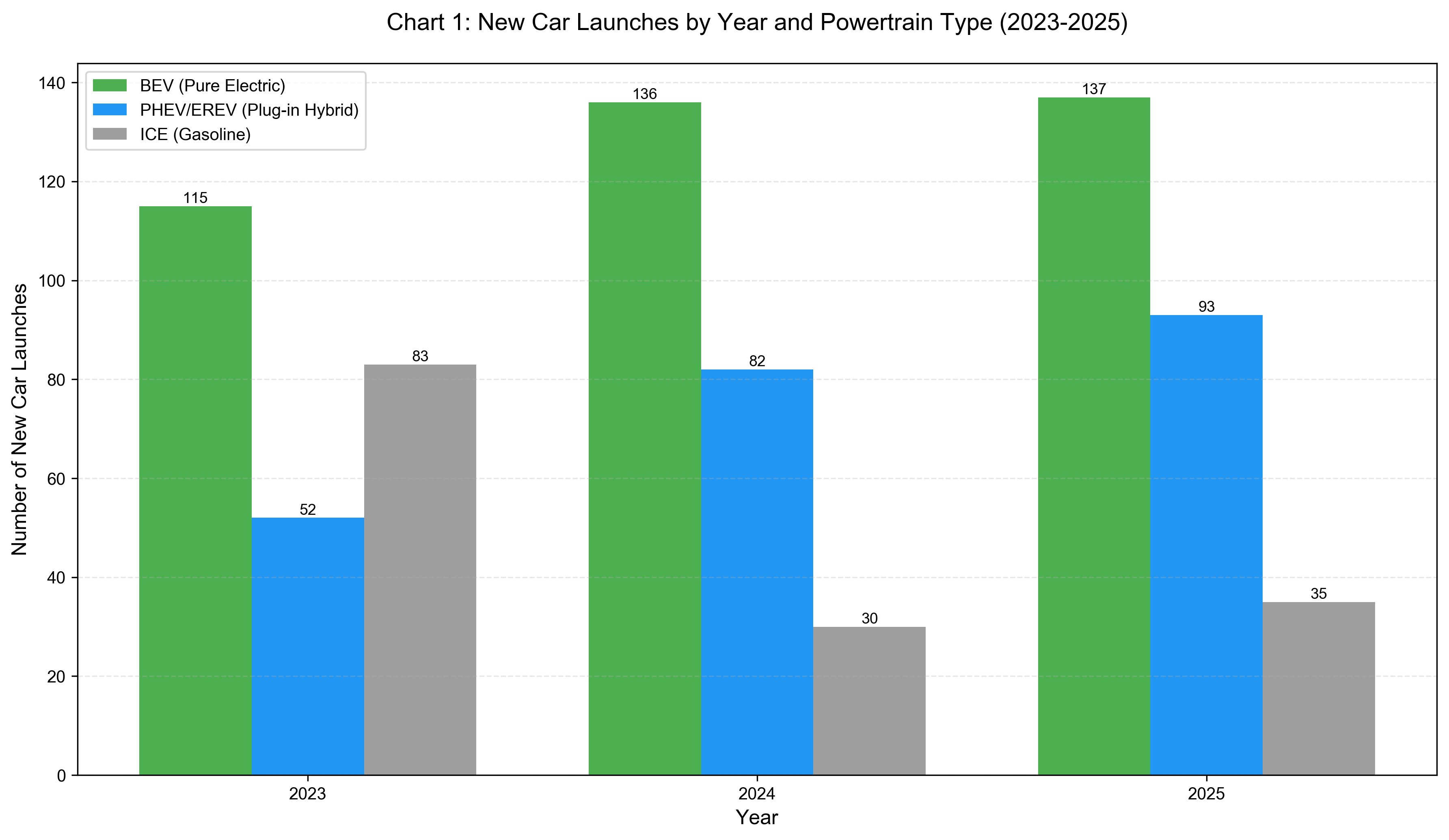

2.1 Significant Increase in Launch Density

In the past 3 years, the frequency of new car launches in China's passenger vehicle market has remained high, showing obvious "technology-intensive" characteristics. Since 2023, new model launches are no longer limited to simple facelifts but are accompanied by high-frequency technological iterations.

- Changes in Launch Entities: Between 2021 and 2024, approximately 20 new brands entered the market (such as Xiaomi, Jiyue, Yangwang, etc.). Although 9 brands exited simultaneously, the total number of brands still shows net growth.

- Technology Democratization Trend: New car launches show "technology democratization" characteristics. The 2024 and 2025 new car lists show that urban NOA (Navigation on Autopilot), 800V high-voltage fast charging, and other features are rapidly cascading from high-end models to mid-to-low price models, becoming standard selling points for new car launches.

2.2 Rising Proportion of Plug-in Hybrid and Extended-Range Models

In the new car launch structure, the proportion of plug-in hybrid electric vehicles (PHEV) and extended-range electric vehicles (EREV) has significantly increased. In response to consumer anxiety about pure electric range, automakers have intensively launched PHEV/EREV models with long-range capabilities in the past 3 years, which highly aligns with changes in market demand.

Definition of “New Car Launch”

In this report, a “new car launch” refers strictly to the introduction of new vehicle models or new vehicle nameplates, excluding routine facelifts, annual model-year updates, and minor configuration refreshes.

For internal combustion engine (ICE) vehicles, most recent product activity in China has concentrated on incremental updates rather than fully new models. As a result, the number of ICE “new launches” appears significantly lower than electrified powertrains under this definition.

3. Sales Performance Overview

3.1 Scissors Gap Between Overall and NEV Sales

China's passenger vehicle market has entered a micro-growth cycle, but NEV penetration continues to climb, becoming the only source of incremental growth.

- Slight Total Growth: Annual total passenger vehicle sales slowly climbed from 21.706 million units in 2023 to 23.737 million units in 2025, with average annual growth maintained in the 3%-5% range.

- High NEV Growth: NEV sales jumped from 7.742 million units in 2023 to 12.809 million units in 2025. Among them, the year-over-year growth rate in 2024 was as high as 40.7%, showing extremely high conversion efficiency of the new car launch wave that year.

3.2 Structural Reversal of Powertrain Types

The power source of sales growth is undergoing profound changes.

- PHEV Explosion: The sales growth rate of plug-in hybrid models far exceeds that of pure electric vehicles. In 2023, PHEV growth was 82.5%, far higher than BEV's 21.0%; in 2024, PHEV continued to maintain high growth of 75.9%. By 2025, although PHEV growth fell to single digits, its contribution to absolute incremental volume cannot be ignored.

- BEV Bottleneck: Although pure electric vehicle sales are growing, some BEV owners (especially in third- and fourth-tier cities) show signs of flowing back to gasoline vehicles or switching to PHEV when replacing vehicles due to poor charging experience. The "regret rate" of BEV owners rose from 3% in 2023 to 22% in 2024.

4. Relationship Between Launch Activities and Sales Realization

4.1 Low Conversion Efficiency of "Price Wars" on Sales

New car launches in the past 3 years have often been accompanied by fierce price competition, but data shows that the marginal effect of this strategy is diminishing.

- Limited Net Stimulation: A 2024 survey showed that the "net stimulation" of price wars on consumer car purchase decisions was only 3.6% (i.e., the number of people accelerating purchases minus the number of people delaying purchases due to wait-and-see). Over 60% of consumers held a neutral attitude toward price wars and did not accelerate purchases as a result.

- Ineffective Involution: Although automakers compete for market share by frequently launching "lower-priced" new cars, this "involution" has not brought significant additional demand but has instead intensified consumers' wait-and-see sentiment.

4.2 Technological Innovation is the Core Driver of Sales Realization

Contrary to price wars, new car launches driven by technological innovation are more effective in converting to sales.

- Innovation Premium: The net stimulation from shortened new car R&D cycles and new technology applications (such as advanced autonomous driving and ultra-fast charging) is as high as 10.8%, three times the effect of price wars.

- Autonomous Driving Monetization Pressure: Although consumer interest in autonomous driving functions has increased, influenced by leading automakers' "free standard" strategies, consumers' willingness to pay separately has declined. This means new car launches must gain sales through "standard high-tech" rather than relying on later software fees.

5. Market Absorption Capacity and Product Concentration

5.1 Head Effect Intensifies, Long-Tail Brands' Survival Space Squeezed

Although the number of new car launches has surged, market absorption capacity shows extremely strong head concentration characteristics.

- Brand Concentration: BYD won the sales championship for three consecutive years from 2023-2025, with sales exceeding 3.5 million units in 2024. Meanwhile, in the top 50 rankings, some joint venture brands' sales continued to decline, with market share concentrating toward leading domestic brands (such as BYD, Geely, Chery).

- Initial Consideration Set (ICS) Solidification: Although 20 brands were added to the market, consumers' "initial consideration brand list" averages only 3.4 brands. This means many newly launched brands have not entered consumers' pre-selection vision, increasing "ineffective supply" of new car launches.

5.2 Blockbuster Models Monopolize Sales

Sales are highly concentrated in a few blockbuster models and have not become dispersed due to the increase in new car numbers.

- Ranking Solidification: Models such as Model Y, Qin PLUS, Song PLUS, and Seagull have long dominated the rankings. For example, in 2024, both Model Y and Qin PLUS had annual sales approaching 480,000 units. In contrast, many newly launched models are in long-tail positions on the rankings.

- Differentiation Between Traditional and New Forces: Although traditional luxury brands (such as BBA) launch new energy models frequently, they lag far behind Chinese new force brands in brand awareness and sales conversion in the high-end EV market.

Conclusion

The rapid growth of new car launches in China's new energy vehicle market over the past 3 years has achieved total sales realization, but there is serious asymmetry in structure. The main incremental sales do not come from simply piling up model numbers or price wars, but are concentrated in leading automakers with plug-in hybrid/extended-range technology advantages, leading intelligent configurations, and strong brand momentum. For most follower products lacking technological moats, the launch wave has not translated into effective sales growth. The market is accelerating from "a hundred flowers blooming" to an elimination stage of "winner takes all".